"....even using the broad definition of small business that McCain likes, very few owners would see their own taxes rise. That's because the lion's share of taxable income comes from a small number of wealthy businesses. Out of 34.7 million filers with business income on Schedules C, E or F, 479,000 filers fall into the top two brackets, according to an analysis of projected 2009 filings by the nonpartisan Tax Policy Center. The other 34.3 million - or 98.6% - would be unaffected by Obama's proposed rate hike."

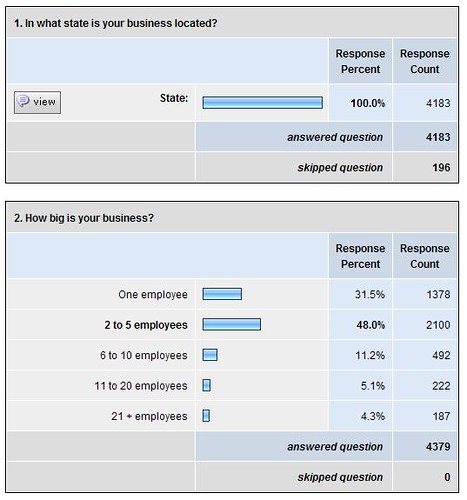

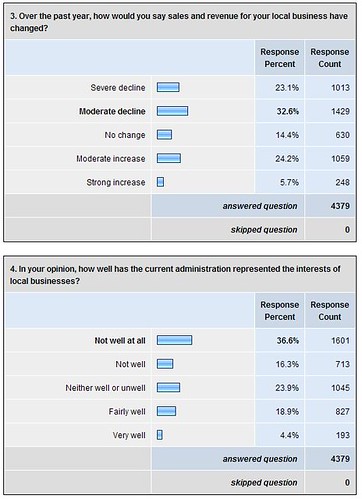

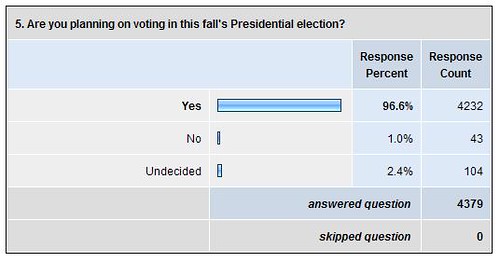

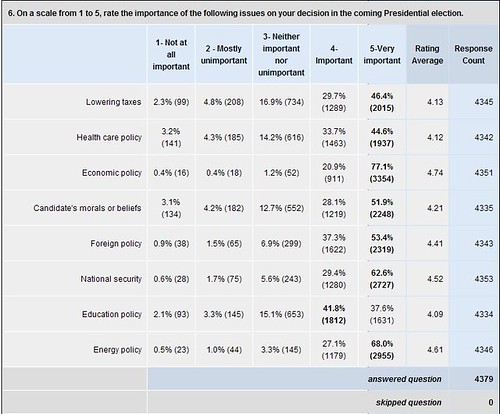

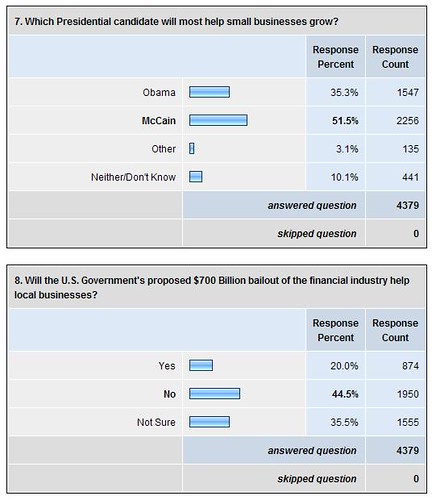

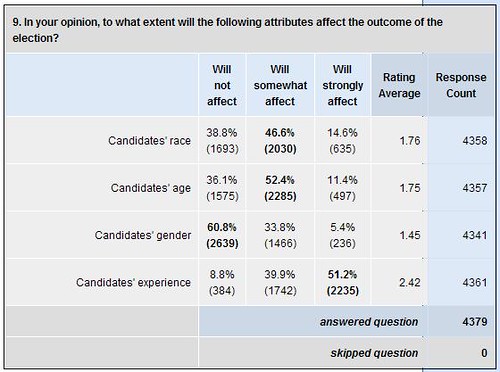

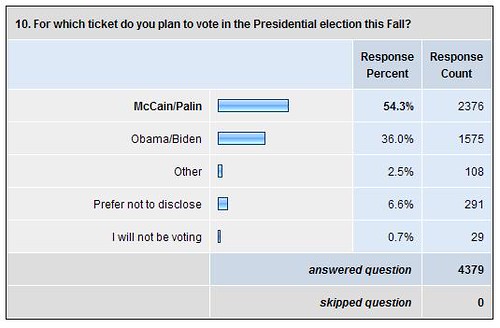

A recent Fortune/Zogby poll showed 45% of small business owners were 'worse off' than they were three years ago. This falls in line with our recent MerchantCircle poll showing more than 55% of business owners seeing a 'moderate' to 'severe' decline in sales and revenue over the last year. Even with those results under the current administration, many small business owners seem to have separated from blaming one party or the other. 54% of members surveyed said they would vote for Senator McCain, compared to 36% for Senator Obama.

Small Business owners around the nation also weighed in on CNN:

"I'd really love to see major change in the government. I don't think the problems are going to be solved in the next four to eight years, but at least we have to start somewhere."

Read what our small business owners are saying here.

In an article on Politico.com, the author argues that raising taxes under Obama's plan would mean less businesses would be interested in expanding, thus less new jobs produced.

"The economic law that 'taxing something more and getting less of it' would apply. Fewer Americans would be interested in opening or expanding small businesses. Tax evasion and legal tax avoidance would spike, as tax shelters would once again become a booming industry."The argument on both sides for who will help out Main Street America the best, is nearing the home stretch. Less than six days remain until election day.

Sincerely,

Kevin

Community Relations

As the financial collapse has spread from Wall Street to Main Street and back,

As the financial collapse has spread from Wall Street to Main Street and back,  As over 4,000 small business owners weighed in on our MerchantCircle

As over 4,000 small business owners weighed in on our MerchantCircle  Well turns out

Well turns out  Joe the Plumber may face a hurdle now that the presidential campaign has brought him to the forefront of national attention. Calls to

Joe the Plumber may face a hurdle now that the presidential campaign has brought him to the forefront of national attention. Calls to  As the economy tightens, and business owners could use more money, MerchantCircle has launched it's

As the economy tightens, and business owners could use more money, MerchantCircle has launched it's  Even as new polls suggest Barack Obama is widening his lead over John McCain amongst likely voters, 53% to 45% supporting Obama

Even as new polls suggest Barack Obama is widening his lead over John McCain amongst likely voters, 53% to 45% supporting Obama